On Two income statements for Cornea Company follow. Cornea Company Income Statements For the Years Ended December 31 20Y9 20Y8 Fees earned 1640000 1300000 Expenses 869200 715000 Net income 770800 585000 Required.

Answered Vertical Analysis Two Income Bartleby

Cornea Company Income Statements For Years Ended.

. Cornea Company Income Statements For Years Ended December 31 2019 2018 Fees earned. Cornea Company Income Statements For Years Ended December 31 20162015 Fees earned16400001300000. Prepare a vertical analysis of Cornea Companys income statements.

Answer of 3Two income statements for Cornea Company follow. Two income statements for Cornea Company follow. Prepare a vertical analysis of Cornea Companys income statements.

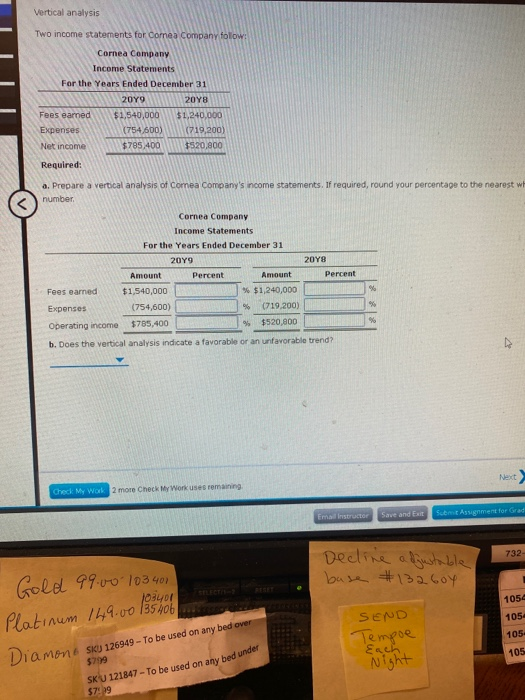

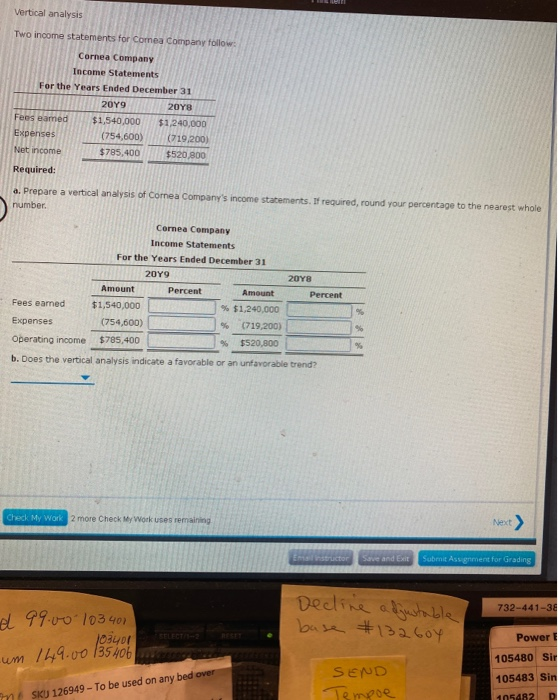

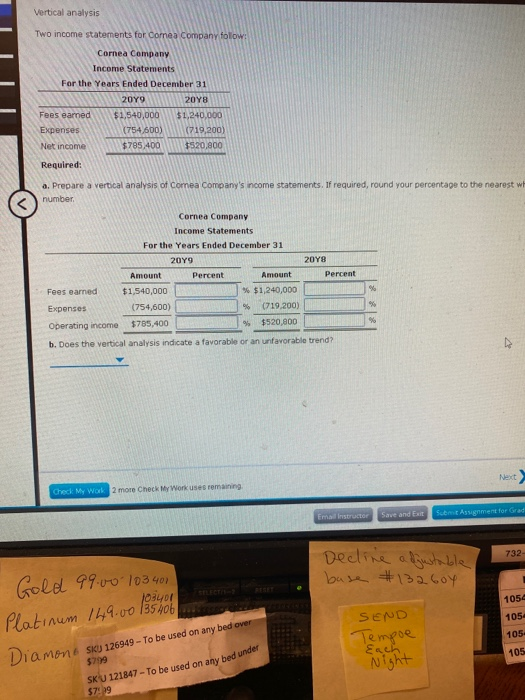

Vertical analysis Two income statements for Cornea Company follow. 770800 585000. Does the vertical analysis indicate a favorable or an unfavorable trend.

869200 715000 Operating income. Cornea CompanyIncome StatementsFor Years Ended December 31 2019 2018 Fees earned 843000 714000 Operating expenses 682830 614040 Operating income 160170 99960 a. Cornea Company Income Statements For Years Ended December 31 1 2016 2015 2 Fees earned 164000000 130000000 3 Operating expenses 86920000 71500000 4 Operating income 77080000 58500000 A.

1 Answer to Two income statements for Cornea Company follow. Prepare a vertical analysis of Cornea Companys income statements. Two income statements for Cornea Company follow.

Two income statements for Cornea Company follow. Prepare a vertical analysis of Cornea Companys income statements. For Years Ended December 31.

Two income statements for Cornea Company follow. Prepare a vertical analysis of Cornea Companys income statements. Cornea Company Income Statements For Years Ended December 31 1 2016 2015 2 Fees earned 164000000 130000000 3 Operating expenses 86920000 71500000 4 Operating income 77080000 58500000 A.

Prepare a vertical analysis of Cornea Companys income statements. Cornea Company Income Statements For Years Ended December 31 1 2016 2015 2 Fees earned 164000000 130000000 3 Operating expenses 86920000 71500000 4 Operating income 77080000 58500000 A. Two income statements for Cornea Company follow.

Prepare a vertical analysis of Cornea Companys income statements. Cornea Company Income Statements For the Years Ended December 31 2019 20Y8 Fees earned 1530000 1390000 Expenses 749700 834000 Net Income 780300 556000 Required. Two income statements for Cornea Company follow.

1640000 1300000 Operating expenses. If required round your percentage to the nearest whole number. Two income statements for Cornea Company follow.

Two income statements for Cornea Company follow. Two income statements for Cornea Company follow. Prepare a vertical analysis of Cornea Companys income statements.

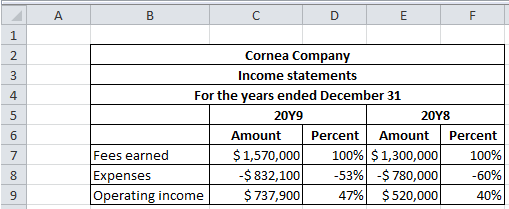

Cornea Company Income Statements For Years Ended December 31 2019 Fees earned S1640000 Operating expenses 869200 Operating income s 770800 2018 S1300000 715000 585000 Prepare a vertical analysis of Cornea Companys income statements. Cornea Company Income Statements For the Years Ended December 31 20Y9 20Y8 Fees earned 1570000 1280000 Expenses 832100 768000 Net income 737900 512000 Required.

Solved Vertical Analysis Two Income Statements For Comea Chegg Com

Solved Vertical Analysis Two Income Statements For Comea Chegg Com

0 Comments